Why your sequence of returns matter

A good lesson for any investor to understand is how the timing of your return affects the performance of your investments. This is especially important in retirement, when you are withdrawing from your invested savings to cover daily living expenses.

It seems like a no-brainer that over the lifetime of your investment you would want to see more positive years than negative. But, what may surprise you is that once you start withdrawing funds, when you experience a positive or negative year is more important.

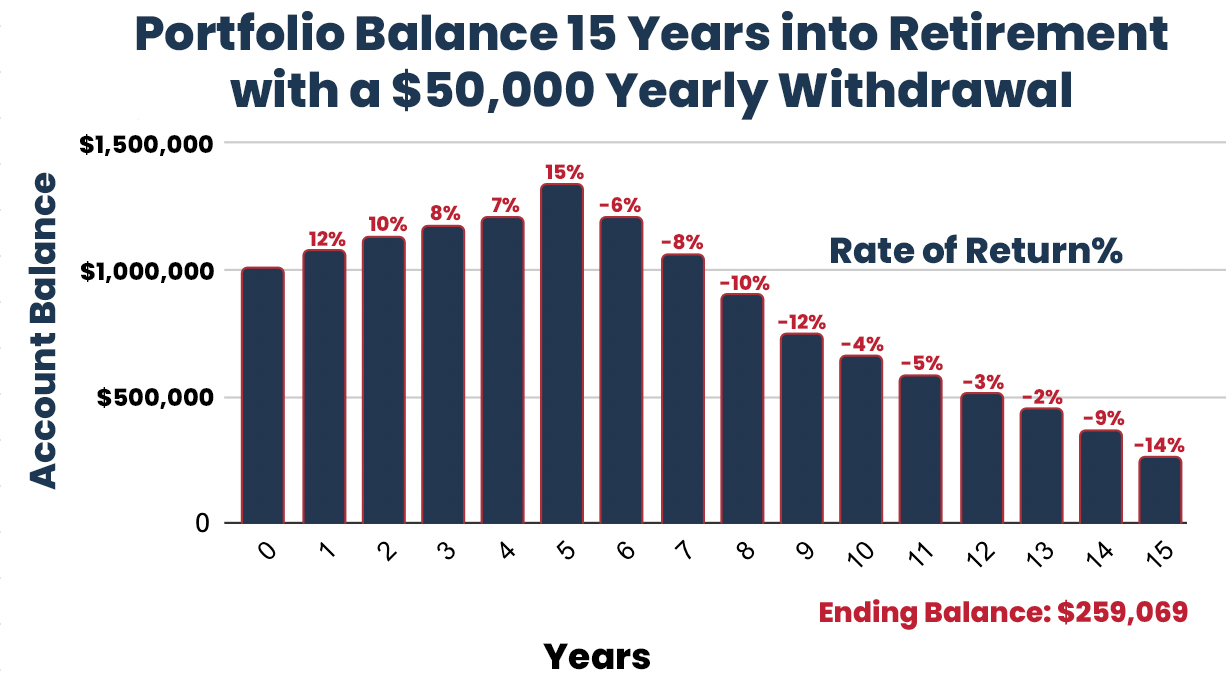

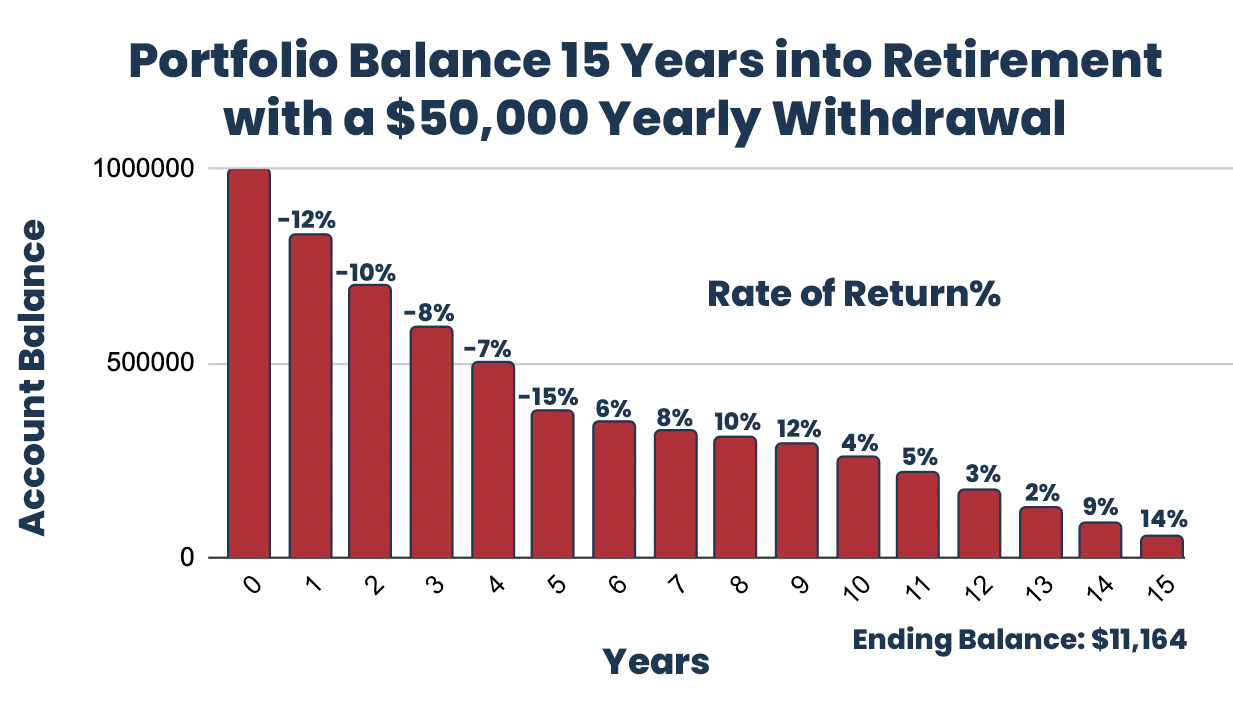

Let’s say you start with $1,000,000 in retirement savings and you need to take $50,000 out per year for retirement. Would you rather see the money a) grow for five years and then decline for fifteen straight years or b) decline for five years and then grow for fifteen straight years? Common sense would say B, less negative years overall, but common sense would be leading you to the wrong conclusion.

This is why, in retirement, the sequence of your returns really matters.

The Math

Let’s break down the numbers. The chart below shows an initial investment of $1,000,000, starting with the A scenario. This investor saw 5 positive years, which helped his money grow to over $1.3m, while still being able to withdraw $50,000 per year. Then the market turned. He saw fifteen years of negative return, still having to take out $50,000 per year, which led to a final tally of about $259,000.

Now, let’s look at the opposite scenario. To keep it fair, we will use the same inverse numbers. The $1,000,000 immediately got hit with five years in a down market and after taking out $50,000 per year, the account is only about $305,000. But, hopefully, they will have the time to make it up. Lucky for them, the market rebounded and they got fifteen years of positive growth. In the end, after continuing to take out the $50,000 per year, the account is left with about $11,000.

Do you see what happened? If your money gets hit early on, and you still need to withdraw funds in retirement, then you won’t have enough principal to bounce back. It is like a racecar driver having to make five pit stops in the first lap, even if you can drive as fast as everyone else for the rest of the race, you already lost your momentum at the start.

The Risk

This example highlights one of the biggest risks to your retirement – market risk. You could save your entire life to build a substantial nest egg, but what if you’re 65 and see a couple bad years? A recession near retirement can significantly erode the financial foundation you have worked so hard for. If you don’t have the time to make it up, and other resources to carry you through, this could be detrimental.

The Solution

Fortunately, there are a couple of solutions. If your portfolio is diversified with non-correlated assets this can help spread the risk, so that all of your eggs won’t get hit in the same basket. Within your equity portfolio, target date funds, or having a three-bucket strategy are great ways to manage this risk, because as you get closer to retirement age your investments become more conservative. This creates a (partial) buffer against a devastating loss to your retirement funds.

Another way is to look for retirement savings vehicles that offer downside protection. This isn’t your only bet, but just another tool to diversify against market risk. In this department, Indexed Universal Life Insurance is a great choice, because if funded correctly, it can grow (tax-free) tracking an index, with the added benefit of 100% downside protection in a falling market. Mission Critical FPI specializes in helping people plan their retirement in a way that anticipates potential pitfalls. Please give us a call today to learn more.