It may surprise you to discover that Financial Advisors recommend saving 20% of your take-home pay every month. In fact, your personal savings rate is more important than any investment return towards building a secure financial future. 20% may not even be enough if you are a high–income earner and you want to continue living your current lifestyle in retirement. In such a case, you should actually be striving to save 30% or more of your post-tax income.

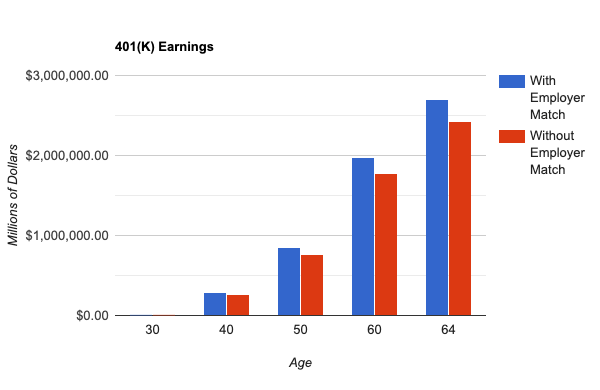

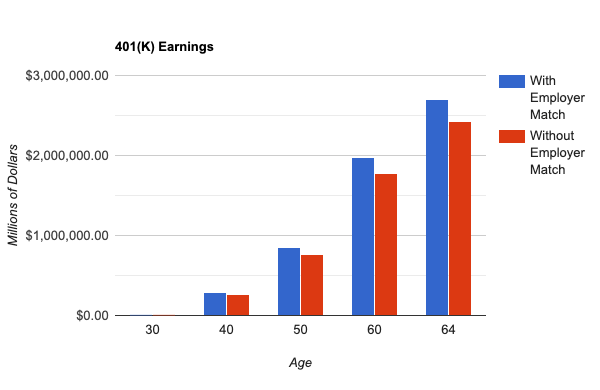

You should begin saving as early as possible to make the greatest use of compound interest – the true factor behind retirement fitness. Looking below, we can see the amount saved by a 30-year-old with a salary of $75,000 who retires at 65 with a $200,000 salary. By saving 20% a year and getting an average return of 7%, you would have close to $2.5 million for retirement! Things look even better if you have a 50% employer match (capping out at 4.5% of your salary).

As you can see, by age 64 you will have a large nest egg that will allow you to live quite comfortably in retirement. If you have other products that provide income, such as annuities or life insurance, you’ll be even better off. Combine this with social security payments, and you will have little to worry about.

As you can see, by age 64 you will have a large nest egg that will allow you to live quite comfortably in retirement. If you have other products that provide income, such as annuities or life insurance, you’ll be even better off. Combine this with social security payments, and you will have little to worry about.

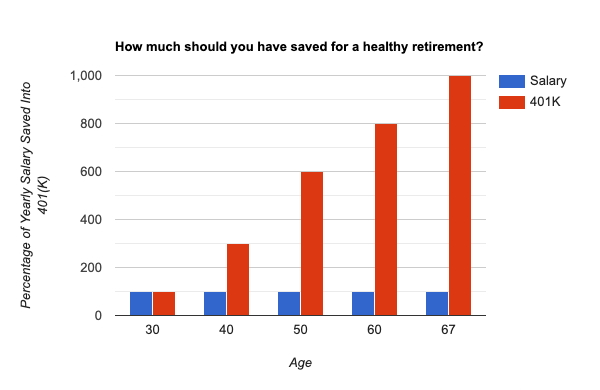

So, by age 30, if you have a salary of $50,000, you should have $50,000 in your 401(K), or 100%. By age 50, you should have 6x your salary saved, and by age 67, 10x your salary should be safely socked away into your 401(K).

So, by age 30, if you have a salary of $50,000, you should have $50,000 in your 401(K), or 100%. By age 50, you should have 6x your salary saved, and by age 67, 10x your salary should be safely socked away into your 401(K).

As you can see, by age 64 you will have a large nest egg that will allow you to live quite comfortably in retirement. If you have other products that provide income, such as annuities or life insurance, you’ll be even better off. Combine this with social security payments, and you will have little to worry about.

As you can see, by age 64 you will have a large nest egg that will allow you to live quite comfortably in retirement. If you have other products that provide income, such as annuities or life insurance, you’ll be even better off. Combine this with social security payments, and you will have little to worry about.

Budgeting

This is an ideal picture for retirement, but to achieve it you must stick to a 20% (or more) savings rate. This requires drafting a budget and vehemently limiting your monthly expenses to no more than 50% of your salary. Generally that means that about 30% should go to rent or a mortgage, and the other 20% to food and all other living expenses (utilities, streaming services, gym membership, gas, vehicle maintenance). This can be especially difficult because the places that often pay the best are also the most expensive to live. Consider that the median average salary in San Francisco is 94% higher than the national average, but that housing costs are 241% higher and grocery costs 30% higher than the national average. In New York City it is even worse, with salaries beating the national average by 141%, but housing costs a whopping 437% more and groceries are 45% more than the national average. Fortunately the world is moving to a more fluid and virtual workspace, so working remotely and moving to a place with a lower cost of living can help you keep your monthly expenses below this 50% threshold.What you have left is 30%.

This is for discretionary spending, meaning date nights, ball games, concerts, and any hobbies you may have or other forms of entertainment you partake in. Keep in mind that any vacations you want to take also fall into this category. Also, keep an eye out for those pesky subscription services – their individual monthly costs seem cheap, but once combined they can take a hefty sum out of your discretionary budget.The 50/30/20 Rule

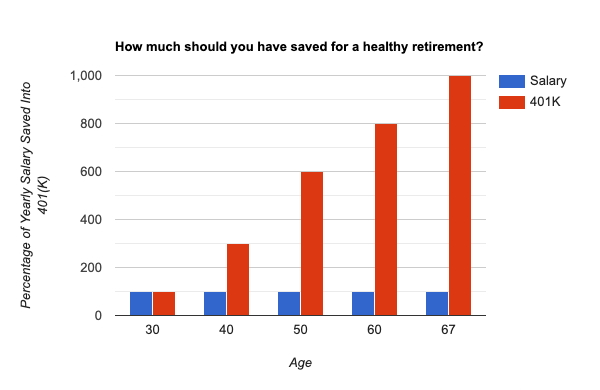

Putting all these percentages together, we get what financial experts call the 50/30/20 rule. And although it is not a hard and fast mandate, it is a pretty crucial guideline to ensuring that you will have enough for retirement. To hit the point home, check out the chart below about how much should be in your 401(K) depending on your age. So, by age 30, if you have a salary of $50,000, you should have $50,000 in your 401(K), or 100%. By age 50, you should have 6x your salary saved, and by age 67, 10x your salary should be safely socked away into your 401(K).

So, by age 30, if you have a salary of $50,000, you should have $50,000 in your 401(K), or 100%. By age 50, you should have 6x your salary saved, and by age 67, 10x your salary should be safely socked away into your 401(K).